The launch of the Federal Reserve’s FedNow Service in July 2023 has seen more than 900 monetary institutions1 offering the service during its first yr of operation. The embrace of FedNow not only signifies trust and effectiveness, however it additionally serves as a promising signal for corporates to undertake it. Some nations have introduced regulatory sandboxes that permit companies to test new technologies in a controlled environment, together with decentralized payment https://www.xcritical.com/ solutions.

Utility tokens with inherent use-case worth quite than speculative belongings spark true tokenomics. Safety tokens representing real-world property generate new capital market opportunities. The ETH404 chain interrelates fractional ownership with NFTs by allowing users to tokenize real-world property and characterize possession stakes as NFTs. These NFTs can then be fractionally divided and traded on the ETH404 chain, enabling buyers to purchase https://earn2learninsurance.com/every-day-analysis/ and sell fractional shares of high-value belongings. In 2022, Utrust was acquired by Elrond Basis, a EU-based DeFi company proudly owning the tenth largest DeFi ecosystem with $2.06 billion in TVL (2021).

Sensible Contracts

Subsequently, this worth is predicted to experience a significant surge, exceeding $3.1 trillion by 2030, as indicated in the 2018 Gartner Pattern Insight Report (Figure 1). To be taught extra about blockchain as a fee possibility, we encourage you to read our eBook on Why B2B Firms Want to Adopt Blockchain Funds. In it, we reply some pressing questions on how blockchain can enhance your transactions and combine into your system. Enterprise funds profit from MEV-resistant transaction ordering by way of non-public RPC endpoints and commit-reveal schemes. Solutions like Flashbots Shield prevent front-running of large cross-border transactions, whereas zk-SNARKs enable selective disclosure of fee details to regulatory authorities with out exposing sensitive industrial information to opponents.

Safe authentication using blockchain can enhance customer experience and safety of transactions and information sharing between businesses and prospects. As blockchain adoption continues to grow, its impact on trading and investing is predicted to deepen, leading to additional innovation within the Decentralized finance financial industry. Blockchain know-how permits buyers to entry world markets seamlessly apart from permitting investors to purchase and trade fractional shares of high-value belongings, such as actual property, art, and stocks.

Introducing cash as a standardized contract, open to any market maker’s bidding, enhances the competitive nature of market making. The necessity for a particular bilateral relationship with issuer A is no longer a prerequisite for market makers to conduct enterprise, thereby enhancing participation and decreasing prices for cross-border funds. Our examine aligns with latest developments within the area, corresponding to implementing blockchain-based commerce finance platforms by major banks whereas providing a more nuanced method to overcoming technological and regulatory hurdles. By proposing this hybrid resolution, our research addresses the gap between on-chain and off-chain governance regarding sensible contracts’ use and primary impression. It offers a possible pathway for banks to comprehend the promised benefits of blockchain know-how, as described in the literature evaluate. This study explored the transformative potential of blockchain technology and good contracts in reshaping trust mechanisms throughout the monetary sector, utilizing JP Morgan’s Quorum platform as a key case study.

Multi Blockchain Architecture For Judicial Case Administration Utilizing Good Contracts

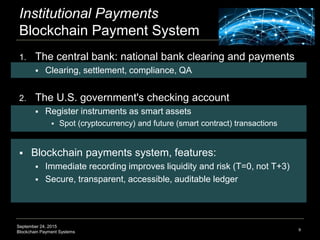

Existing studies on blockchain emphasize the significant advantages of this know-how within the banking sector. Key advantages embrace reducing operational costs, improving transaction safety, and enhancing transparency. For example, (Guo and Liang, 2016) emphasize that blockchain can rework clearing and settlement systems by eliminating intermediaries and optimizing monetary processes. In subsequent years, personal and consortium-based blockchains, similar to Hyperledger and R3 Corda, emerged, specifically designed for corporate and monetary environments. Not Like public blockchains like Bitcoin and Ethereum, these systems limit access to selected individuals, making certain larger compliance with laws and offering enhanced management over knowledge (Dashkevich et al., 2020). This diversification of blockchain technologies has enabled the exploration of complex functions, including digital id management, cross-border payments, and even the issuance of digital currencies by central banks.

Revolutionizing Finance: The Role Of Blockchain Within The Monetary Companies Industry

- Some international locations have clear, supportive tips for blockchain payments, whereas others are extra restrictive.

- Transactions are grouped into blocks and then subjected to a verification process carried out by a distributed computing community earlier than being appended to the blockchain.

- Latest analysis signifies that many banks are excited about utilizing Distributed Ledger Expertise (DLT).

- In that yr, SMEs accounted for 38% of the entire functions submitted to banks but faced the next percentage (45%) of rejections, as reported by ADB (2023) (Figure 4).

- Using letters of credit score (L/C) represents a prevalent methodology of facilitating settlements.

As An Alternative, we now use Layer 2 “Rollups.” These networks bundle 1000’s of transfers off-chain and process them instantly, only writing the ultimate end result back to the main blockchain. This is how platforms now achieve VISA-level transaction throughput without crashing the network. Governance points similar to centralization of decision-making energy, conflicts of interest what does blockchain payment mean, and lack of transparency also impact the stability and trustworthiness of blockchain networks. Thus, transparent and inclusive governance mechanisms ought to be established to ensure the long-term sustainability and decentralization of blockchain networks. While blockchain presents transparency and immutability, ensuring data privacy and confidentiality is important to defending consumer information and stopping unauthorized access or data breaches.

Cost Comparison: Traditional Vs Blockchain Payments

These self-executing digital contracts allow the automation of complicated financial processes similar to mortgage issuance, insurance management, and commerce finance transactions. For instance, R3 Corda, a blockchain platform utilized by international monetary establishments, helps the implementation of sensible contracts for commerce finance processes, decreasing the chance of errors and accelerating financial workflows (Tikhomirova & Soia, 2019). The future of blockchain in finance is promising, with vast potential to revolutionize the trade. Blockchain’s capacity to tokenize property, streamline cross-border payments, and facilitate real-time transactions is remodeling conventional finance. The capabilities to increase liquidity, discover world private markets, and process transactions faster will all increase the finance industry. Blockchain’s ability to create good contracts, tokenization, and decentralized finance are a number of the most original innovative advancements within the final 10 years, and investors are rising funds that can disrupt industries and create completely new markets.

Leave a Reply